I get questions about how the role of debt works in a Bitcoin economy with a deflationary currency. Here is how I think about it.

In a hyperbitcoinized world people will be operating on deflationary money. Money that goes up in value over time. This force incentivizes individuals not to borrow money because the value that will have to be paid back will be much greater than the value at which they borrowed. Every borrower is at risk of not being able to keep up with the rising value, and every lender is at greater risk of defaults. This underlying incentive will greatly reduce the debt market as a whole. Individuals will be incentivized to save money and make purchases in the future rather than pulling the purchase forward in time with debt. In this economy savings will rise and the overall debt will drop by 95%-100%.

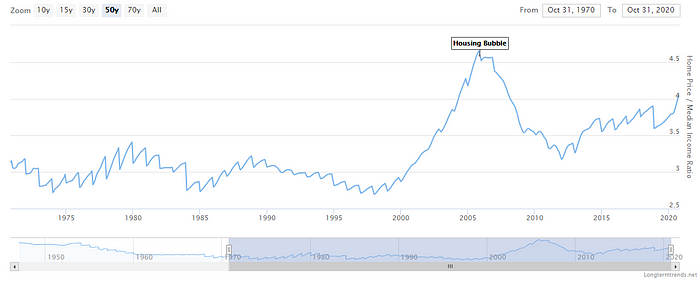

“But what about buying a home? People cant save up enough to buy a home.” In the hyperbitcoinized world the reduction in debt and the rise in savings will pull the monetary premium out of residential homes. Currently residential real estate has a 80%–90% monetary premium built in from people holding real estate as a store of value and people pulling monetary value from the future through mortgages to put into residential real estate. In a hyperbitcoinized economy the value or the purchasing power required to purchase a home will be reduced drastically. Currently the home value/median income ratio is around 4 years of income.

When the monetary premium is removed from real estate it will only take 3–4 months of a median income to purchase a home. This will be the result of the debt market reduction pushing the value from the present into the future. This will also result in home prices falling over time in line with their true value as they age and break down like all other depreciating consumer goods.

Most likely we will see a lot more shared living spaces as individuals chose to save instead of spend savings for a whole home for themselves. We may also see more multigenerational family homes as the traditional family strengthens again.

The Bitcoin economy is going to look a lot different than our current economy and this is just a small part of the changes that are coming.